Online Courses

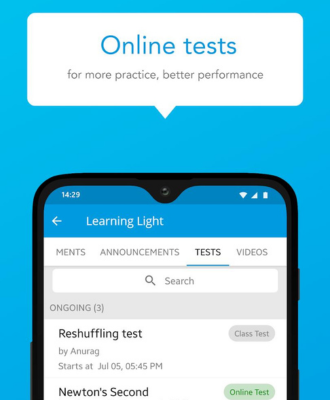

Mobile Application

Available For Your Smartphones

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Install app now on your Smartphones

Course Curriculum

Course Overview

1. Introduction to Stock Markets (Basic Course)

- Understanding Stock Markets

- Financial Instruments

- Market Participants

- Basic Terminologies

- How Stocks are Traded

- Factors Influencing Stock Prices

- Risk and Return

2. Technical Analysis Mastery

Introduction to Technical Analysis

Basic Charting Techniques :-

- Line charts, bar charts, and candlestick charts

- Understanding price, volume, and time axes

- Identifying trends and trendlines

Support and Resistance Levels :-

- Definition and significance of support and resistance

- Drawing support and resistance lines and trendlines

- Role reversal and breakout patterns

Chart Patterns :-

- Continuation patterns (flags, pennants, rectangles)

- Reversal patterns (head and shoulders, double tops and bottoms)

- Understanding the psychology behind chart patterns

Technical Indicators :-

Trend Analysis :-

Volume Analysis :-

Practical Application and Case Studies :-

Chart Analysis Techniques :-

- Common candlestick patterns (doji, hammer, engulfing patterns)

- Japanese candlestick reversal patterns

- Using candlestick patterns in conjunction with other technical tools

Candlestick Patterns :-

- Common candlestick patterns (doji, hammer, engulfing patterns)

- Japanese candlestick reversal patterns

- Using candlestick patterns in conjunction with other technical tools

Risk Management in Technical Analysis :-

- Setting stop-loss orders based on technical levels

- Position sizing and risk-reward ratios

- Backtesting trading strategies and risk assessment

Developing Trading Strategies :-

- Trend-following strategies (moving average crossover, trendline breakouts)

- Counter-trend strategies (RSI divergence, reversal patterns)

- Combining multiple technical tools for strategy development

3. THE SETUP FOR EQUITY.. (FOR SWING/FOR INTRADAY)

- Rules for setup and how to apply it

- Setup for swing trading

- Setup for intraday trading

4. EXPLORING THE WORLD OPTIONS AND DERIVATIVES STRATEGIES

Introduction to Derivatives :-

Futures Contracts :-

Options Contracts :-

Practical Application and Case Studies :-

Option Payoff Profiles :-

- Understanding option payoff diagrams

- Long and short positions in options

- Calculating option payoffs at expiration

Option Pricing Models :-

- The Black-Scholes option pricing model

- Factors influencing option prices (underlying asset price, volatility, time to expiration, interest rates)

- Implied volatility and its significance in option pricing

Basic Options Strategies :-

- Long call and put options

- Covered call and put options

- Protective puts and covered puts

Advanced Options Strategies :-

- Bullish strategies (bull call spread, bull put spread)

- Bearish strategies (bear call spread, bear put spread)

- Neutral strategies (straddle, strangle, butterfly, iron condor)

Futures Trading Strategies :-

- Speculative trading strategies using futures contracts

- Hedging strategies for managing commodity price risk

- Spread trading strategies (calendar spreads, inter-commodity spreads)

Options Greeks :-

- Delta, gamma, theta, vega, and rho

- Understanding the sensitivity of option prices to changes in different variables

- Using Greeks to manage options positions and assess risk

Risk Management in Futures and Options Trading :-

- Understanding leverage and margin requirements

- Calculating and managing position delta and gamma

- Implementing stop-loss orders and risk mitigation strategies

5. THE SETUP FOR F&O.. ( For Delivery/For Interaday/For Swing )

- Rules for setup and how to apply it

- Setup for delivery future and options trading

- Setup for intraday future and options trading

- Setup for scalping future and options trading

6. Advance Trading Techniques

7. THE SETUP FOR F&O.. ( For Delivery/For Interaday/For Swing )

- Rules for setup and how to apply it

- Setup for delivery future and options trading

- Setup for intraday future and options trading

- Setup for scalping future and options trading

8. Live Trading Sessions and Case Studies)

9. Personalized Coaching and Mentorship

- One-on-one sessions with experienced mentors

- Tailored guidance based on individual learning goals and trading style

- Continuous support and feedback throughout the program

Get Your Queries Solved. Talk To Our Counsellor

Get the Online learning experience

Our Success Ratio

Students Mentored

0

+

Sessions Finished

0

+

Google Rating

0

Revision Classes

0

+